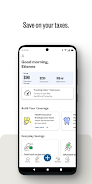

Stride: Mileage & Tax Tracker

by Stride Health Nov 08,2023

Introducing Stride: Mileage & Tax Tracker, the completely free app designed to help business owners easily track their expenses and mileage, saving them thousands on their tax bill. Perfect for independent workers, Stride's mileage tracker automatically captures your business miles and expenses, mak

Application Description

Application Description  Apps like Stride: Mileage & Tax Tracker

Apps like Stride: Mileage & Tax Tracker