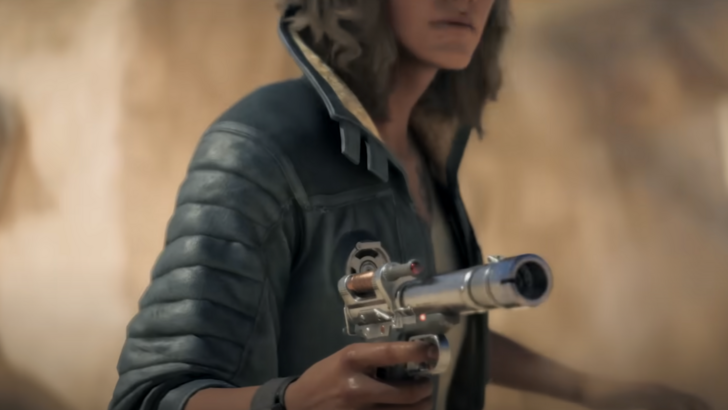

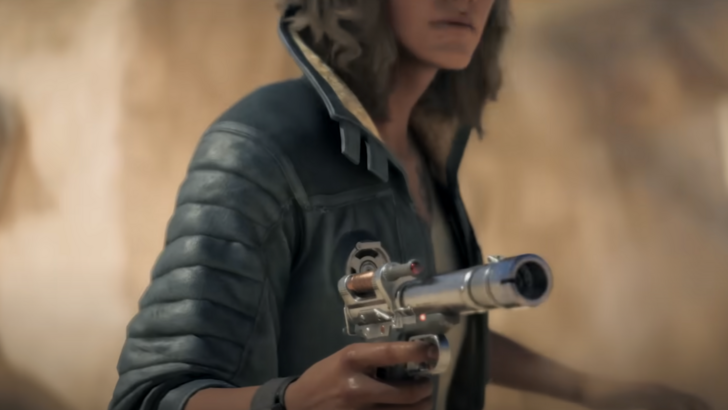

Ubisoft's anticipated Star Wars Outlaws launch hasn't delivered the expected sales boost, resulting in a drop in the company's share price last week. The game's performance has fallen short of projections, despite positive critical reception.

Ubisoft's anticipated Star Wars Outlaws launch hasn't delivered the expected sales boost, resulting in a drop in the company's share price last week. The game's performance has fallen short of projections, despite positive critical reception.

Ubisoft Banking on Star Wars Outlaws and Assassin's Creed Shadows for Recovery

Stock Price Decline Continues

Ubisoft positioned Star Wars Outlaws as a key title to improve its financial standing. While critics generally praised the game, sales have been weaker than anticipated, leading to consecutive share price declines beginning September 3rd.

Ubisoft positioned Star Wars Outlaws as a key title to improve its financial standing. While critics generally praised the game, sales have been weaker than anticipated, leading to consecutive share price declines beginning September 3rd.

Ubisoft heavily invested in Star Wars Outlaws and the upcoming Assassin's Creed Shadows (AC Shadows), viewing them as crucial long-term assets. Their Q1 2024-25 report emphasized these titles' importance in reshaping the company's financial future. The report also highlighted a 15% increase in console and PC session days, primarily driven by Games-as-a-Service offerings. Monthly active users (MAUs) reached 38 million, a 7% year-on-year increase.

Reports describe Star Wars Outlaws sales as sluggish. Reuters cited J.P. Morgan analyst Daniel Kerven, who noted the game's failure to meet sales expectations despite positive reviews. Kerven revised his sales forecast from 7.5 million units to 5.5 million units through March 2025.

Following the August 30th release, Ubisoft's stock fell for two consecutive days, dropping 5.1% on Monday, September 3rd, and a further 2.4% by Tuesday morning. This marks the lowest share price since 2015, adding to a year-to-date decline of over 30%.

Following the August 30th release, Ubisoft's stock fell for two consecutive days, dropping 5.1% on Monday, September 3rd, and a further 2.4% by Tuesday morning. This marks the lowest share price since 2015, adding to a year-to-date decline of over 30%.

While critical reception was largely positive, player response appears less enthusiastic. Metacritic currently shows a user score of just 4.5 out of 10. Conversely, Game8 awarded Star Wars Outlaws a 90/100 rating, praising it as an exceptional game that honors the Star Wars franchise. For a detailed review, see the link below.

Ubisoft's anticipated Star Wars Outlaws launch hasn't delivered the expected sales boost, resulting in a drop in the company's share price last week. The game's performance has fallen short of projections, despite positive critical reception.

Ubisoft's anticipated Star Wars Outlaws launch hasn't delivered the expected sales boost, resulting in a drop in the company's share price last week. The game's performance has fallen short of projections, despite positive critical reception. Ubisoft positioned Star Wars Outlaws as a key title to improve its financial standing. While critics generally praised the game, sales have been weaker than anticipated, leading to consecutive share price declines beginning September 3rd.

Ubisoft positioned Star Wars Outlaws as a key title to improve its financial standing. While critics generally praised the game, sales have been weaker than anticipated, leading to consecutive share price declines beginning September 3rd. Following the August 30th release, Ubisoft's stock fell for two consecutive days, dropping 5.1% on Monday, September 3rd, and a further 2.4% by Tuesday morning. This marks the lowest share price since 2015, adding to a year-to-date decline of over 30%.

Following the August 30th release, Ubisoft's stock fell for two consecutive days, dropping 5.1% on Monday, September 3rd, and a further 2.4% by Tuesday morning. This marks the lowest share price since 2015, adding to a year-to-date decline of over 30%. LATEST ARTICLES

LATEST ARTICLES